south dakota sales tax rate on vehicles

Click here for a larger sales tax map or here for a sales tax table. With local taxes the total sales tax rate is between 4500 and 7500.

What Rates may Municipalities Impose.

. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. South Dakota levies a 4 sales tax rate on the purchase of all vehicles. The South Dakota sales tax and use tax rates are 45.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. 31 rows The state sales tax rate in South Dakota is 4500. Rapid Valley SD Sales Tax Rate.

366 rows There are a total of 290 local tax jurisdictions across the state collecting an average local tax of 1817. That is the amount you will need to pay in sales tax on your. 2022 South Dakota state sales tax Exact tax amount may vary for different items The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. To calculate the sales tax on a car in South Dakota use this easy formula. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation.

For vehicles that are leased or rented see Lease and Rental Taxation. In addition to taxes car purchases in. First multiply the price of the car by 4.

South Dakota has recent rate changes. Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division. All car sales in South Dakota are subject to the 4 statewide sales tax.

South Dakota charges a 4 excise sales tax rate on the. Different areas have varying additional sales taxes as well. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

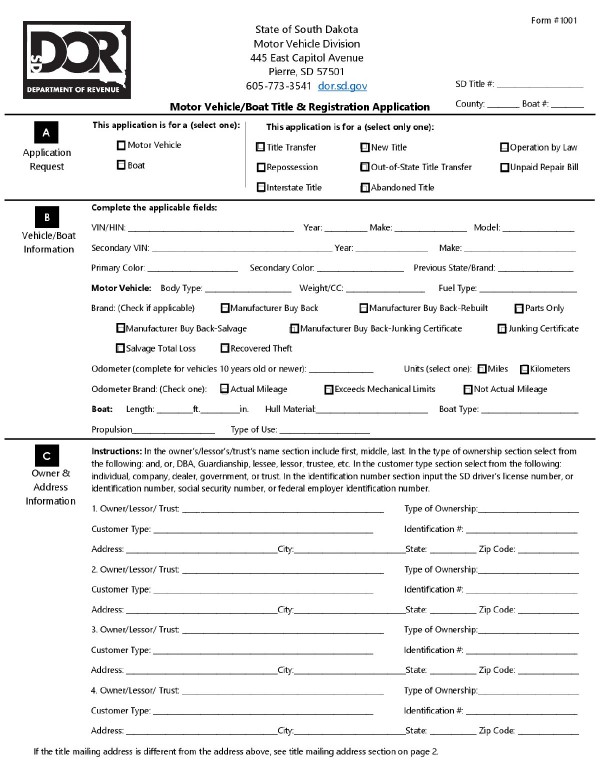

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. Redfield SD Sales Tax Rate. The highest sales tax is in Roslyn with a.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Historical South Dakota Tax Policy Information Ballotpedia

How Do State And Local Sales Taxes Work Tax Policy Center

Titles Licensing Lawrence County Sd

Sales Taxes In The United States Wikipedia

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Nj Car Sales Tax Everything You Need To Know

All Vehicles Title Fees Registration South Dakota Department Of Revenue

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Bills Of Sale In South Dakota The Forms And Facts You Need

Nj Car Sales Tax Everything You Need To Know

South Dakota Sales Tax Small Business Guide Truic

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident