nh business tax calculator

Business Enterprise Tax RSA 77-E. As of December 2018 the state of New Hampshire reduced the tax rates for two types of tax.

That means they are due on the 15th of the 4th 6th 9th and 12th month.

. New Hampshire Income Tax Calculator 2021 If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. New Hampshire Sales Tax Calculator. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes.

New employers should use 27. Enter Business Name if applicable Enter Primary First Name Enter Primary Middle Initial Enter Primary Last Name Enter Address Line 1 Enter Address Line 2 if applicable Enter City Enter State Enter Zip Code Enter CountyProvince and Country if outside of the United States. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Related

Find our comprehensive sales tax guide for the state of New Hampshire here. New Hampshire Real Estate Transfer Tax Calculator The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. 000 New Hampshire State Sales Tax 000 Maximum Local Sales Tax 000 Maximum Possible Sales Tax 000 Average Local State Sales Tax.

For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Concord NH 03301.

Your average tax rate is 1198 and your marginal tax rate. 0 5 tax on interest and dividends Median household income. Calculate By ZIP Codeor manually enter sales tax New Hampshire QuickFacts.

The New Hampshire Department of Revenue is responsible. These tax cuts were a result of the state meeting revenue goals in 2017. Businesses the gross less than 50000 are not required to file for business profits tax.

For 2020 through 2021 the tax rate is 77. According to a 2019 state tax analysis if you moved to New Hampshire from a state with higher taxes like New York or California the average. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck State payroll tax.

New Hampshire Business Profits Tax BPT If you operate a business within the state of New Hampshire youll have to pay taxes on any profits that you make. Enter your info to see your take home pay. To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The tax applies to income from business activity in the state applied before any federal net operating loss or special deductions and with various state-specific additions and deductions. Similar to the personal income tax businesses must file a yearly tax return and are allowed deductions such as wages paid cost of goods sold and other qualifying business expenses.

The New Hampshire Business Profits Tax BPT rate went from 82 to 79 and the New Hampshire Business Enterprise TaxBET rate dropped from 072 to 0675. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. New Hampshire Business Enterprise Tax and New Hampshire Business Profits Taxes are due at the same time your federal return is due.

With no income tax on wages and no sales tax its no wonder that New Hampshire has the 11th lowest tax burden of all 50 states and Washington DC. Your household income location filing status and number of personal exemptions. You must pay the estimated taxes on the 15th of each of the four months of your fiscal year.

You must pay the estimated taxes on the 15th of each of the four months of your fiscal year. New Hampshire income tax rate. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125.

The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. Only two other states Delaware and Virginia have similar stacking gross receipts taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

New Hampshire Corporate Income Tax Comparison A home business grossing 55000 a year pays 467500 A small business earning 500000 a year pays 425000 A corporation earning 10000000 a year pays 85000000 12 - New Hampshire Nonprofit Tax Exemptions. For 2022 and later the rate lowers to 76. If youre looking to become one of New Hampshires 133000 small businesses you need to consider setting up a business entity for your company.

Get Details on Business Profits Tax. The current BPT rate in New Hampshire is 77. If you use Northwest Registered Agent as your New Hampshire registered agent youll have an online account to track your company in receive notification reminders to file your annual reports on time annual tax.

The New Hampshire Business Profits Tax BPT rate went from 82 to 79 and the New Hampshire Business Enterprise Tax BET. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. The New Hampshire State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New Hampshire State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

While New Hampshire used to have an estate tax called the Legacy Succession Tax it was repealed in 2002. New Hampshire Department of Revenue. New Hampshire Estate Tax.

Tennessee currently has the lowest tax burden. Up to 25 cash back New Hampshires business profits tax is charged at a flat rate. The Business Enterprise Tax the BET is an entity level tax imposed upon all business enterprises slightly different than business organizations for the BPT which carry on any business activity in New Hampshire including corporations limited liability companies partnerships sole.

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

State Corporate Income Tax Rates And Brackets Tax Foundation

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Fshad Cpa Tax Accounting Services Accounting Services Professional Accounting Accounting Firms

Elegant Cpa Certified Public Accountant Business Card Zazzle Com Certified Public Accountant Accounting Cpa

State Corporate Income Tax Rates And Brackets Tax Foundation

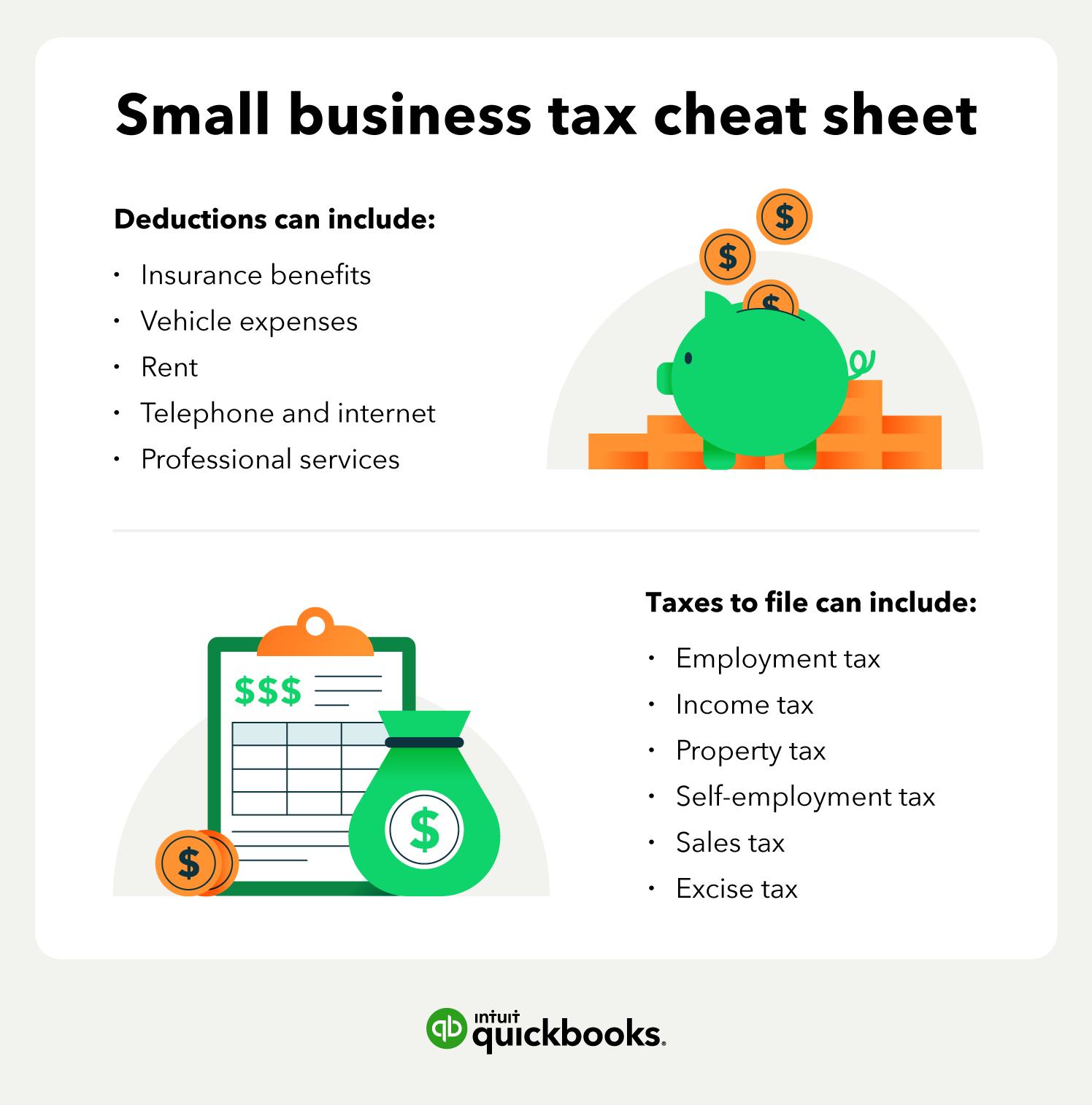

Small Business Tax Services What You Should Know Article

Llc Tax Calculator Definitive Small Business Tax Estimator

4 Tax Tips Every Small Business Needs To Know Bookkeeping Services Startup Funding Business

Free Llc Tax Calculator How To File Llc Taxes Embroker

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

2022 Federal State Payroll Tax Rates For Employers

Here S How Much Money Accountants And Tax Preparers Earn In Every State

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

Infographic The U S States With The Highest Lowest Student Debt Student Debt Infographic Student Debt Educational Infographic

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Free Llc Tax Calculator How To File Llc Taxes Embroker